Furucombo

Furucombo has recently been awarded an IOTA grant. With this grant, Furucombo plans to enhance the IOTA ecosystem by attracting new users and investments. This support will enable Furucombo to make an impact and drive further growth in the IOTA ecosystem.

Overview

Furucombo is a DeFi aggregator designed to simplify the complexities of DeFi for users across multiple blockchain networks. It offers a user-friendly interface that enables users to create, manage, and optimize their DeFi strategies efficiently. By integrating various DeFi protocols like Aave, Uniswap, and Stargate into a single platform, Furucombo allows users to perform complex multi-step transactions with ease. The core value proposition of Furucombo is its ability to streamline and automate DeFi operations, reducing the manual effort and technical expertise required to execute sophisticated trading and investment strategies.

Key Features of Furucombo:

- Create Mode

- The Create Mode allows users to easily drag and drop cubes representing different DeFi trading actions, enabling them to chain actions together to execute complex ‘combos’ in a single transaction.

- Lending Dashboard

- The Lending Dashboard provides a user-friendly interface for managing positions in lending protocols, simplifying strategy execution with just a click.

- Flash Loans

- Flash Loans enable users to take out and repay loans within one transaction with no interest, facilitating advanced position management and arbitrage opportunities without the need for personal smart contract development. These are often used by developers and automated bots to run automated strategies, usually arbitraging price differences across markets.

Furucombo’s integration with multiple DeFi protocols enhances its functionality. For instance, users can interact with protocols like Uniswap v3 for token swaps, Aave for lending and borrowing, ParaSwap for decentralized exchange aggregation, and Compound for additional lending and borrowing operations. This integration allows users to execute complex strategies such as yield farming, leveraged trading, collateral swaps, arbitrage, and debt management all within a single, cohesive platform.

Examples of DeFi Strategies Possible via Furucombo

- Yield Farming and Staking:

- Users can create a strategy that swaps tokens for a desired asset, provides liquidity on a platform like Uniswap, and stakes the LP tokens in a yield farm, all in one transaction. This maximizes the efficiency of yield farming by automating the entire process from swapping to staking.

- Leveraged Trading:

- Users can deposit collateral on Aave, borrow assets, and then swap these borrowed assets for another token. This strategy allows users to gain leveraged exposure to the market without multiple individual transactions, making it easier to manage and execute. One common example of this is “looping”, which consists in using a yield-bearing asset as collateral to borrow against it then swap the borrowed asset for the collateral asset again and repeat multiple times to get leveraged exposure to an interest rate. This strategy is highly profitable when the yield earned on the collateral is greater than the borrow cost (i.e. earn 5% on the collateral and borrow at 2% to capture a 3% spread that, when looped multiple times, can give leveraged exposure.

- Collateral Swaps:

- Users can use a flash loan to swap the collateral in a lending protocol like Aave without upfront funds. For instance, they can borrow an asset, use it to pay off the current loan, and then take out a new loan in a different asset, all within a single transaction and zero-interest.

- Arbitrage:

- Users can identify price discrepancies between different exchanges and create a strategy to buy low on one exchange and sell high on another. For example, using a flash loan to buy a token on Uniswap and then selling it on SushiSwap for a profit, all executed seamlessly within one transaction.

- Debt Management:

- Users can manage their debt positions by using Furucombo to repay and re-borrow on lending platforms like Aave or Compound. This helps optimize their interest rates and collateral usage, making debt management more efficient and less risky.

What Problem Furucombo is Solving

Furucombo addresses critical challenges within the DeFi space, such as the complexity and usability of most DeFi platforms, which often require multiple transactions across different protocols, making the process cumbersome and error-prone. Furucombo simplifies these processes by enabling users to bundle multiple actions into a single transaction, reducing errors and enhancing the user experience.

Technical barriers also present a significant challenge, as many operations require coding skills, particularly for advanced strategies like flash loans. Furucombo eliminates this barrier with a no-code interface, allowing users to execute complex strategies without programming knowledge.

Additionally, executing multiple steps individually can be inefficient and costly. Furucombo optimizes these processes through its proxy contract, ensuring transactions are executed efficiently and reducing gas costs. The platform also addresses the challenge of managing DeFi positions by consolidating various positions across different protocols into a single interface, making it easier to manage and optimize lending and borrowing activities.

Target Users of Furucombo

DeFi Beginners:

- Furucombo can be beneficial for DeFi beginners as the platform offers a user-friendly drag-and-drop interface that simplifies DeFi operations, making it approachable for newcomers. This ease of use helps beginners engage with DeFi without feeling overwhelmed by the technical aspects.

Experienced DeFi users:

- Experienced DeFi users will appreciate Furucombo’s ability to streamline and optimize their strategies. By bundling multiple actions into a single transaction, the platform enhances efficiency and performance, allowing these users to execute their strategies more effectively.

Traders and Investors:

- Traders and investors often need to perform complex strategies involving multiple protocols. Furucombo enables them to execute sophisticated trades and investments with greater ease and efficiency, supporting strategies such as yield farming, leveraged trading, and arbitrage.

Developers:

- Developers and DeFi enthusiasts looking to integrate DeFi functionalities into their projects or experiment with new strategies will benefit from Furucombo’s versatile toolset. The platform provides an accessible environment for building and testing various DeFi strategies, fostering innovation and development within the ecosystem.

Sector Outlook

The DeFi strategies sector is a rapidly growing area within DeFi, focusing on optimizing and automating complex financial operations. This sector includes platforms and tools that facilitate sophisticated strategies such as yield farming, leveraged trading, collateral management, arbitrage, and automated portfolio management. By integrating with multiple DeFi protocols, these platforms aim to maximize returns, enhance efficiency, and reduce risks for users.

The significance and growth of the DeFi strategies sector are driven by several key factors. Firstly, there is an increasing user demand for simplification. As the DeFi landscape becomes more intricate, users seek tools that can simplify complex financial operations, making it accessible to both novices and experienced users. Secondly, these platforms enhance transaction efficiency by bundling multiple actions into single transactions, reducing gas fees, and optimizing execution paths. Thirdly, advanced risk management features, such as automated strategy adjustments and real-time monitoring, help users navigate the volatile nature of DeFi markets more safely.

Similar dApps in the Sector:

Several key platforms highlight the importance and growth of the DeFi strategies sector. Furucombo, for instance, is a DeFi aggregation protocol that offers a user-friendly, drag-and-drop interface for creating and executing complex multi-step transactions. This platform simplifies DeFi operations and reduces the need for technical expertise by allowing users to bundle multiple DeFi actions into a single transaction.

Aera by Gauntlet focuses on dynamic risk management and optimization, adjusting strategies based on real-time market conditions to maximize capital efficiency and minimize risks. Aera’s automated strategy adjustments and integration with major protocols highlights the growing trend toward automated, risk-optimized DeFi strategies.

DeFi Saver provides automation and monitoring tools for managing DeFi positions, offering features like automated debt management and liquidation protection. Its emphasis on continuous automation and real-time monitoring highlights the importance of maintaining and protecting DeFi positions in a volatile market.

Instadapp offers a middleware layer that connects multiple DeFi protocols, enabling users to manage and optimize their assets and positions through a unified interface. This platform’s integration with various protocols and its focus on ease of use demonstrate the sector’s drive towards more accessible and efficient DeFi management solutions.

One of the key trends in the DeFi strategies sector is cross-protocol integrations, where platforms integrate with multiple DeFi protocols to offer comprehensive strategies that leverage diverse financial instruments. Additionally, the use of automation and AI for real-time strategy adjustments and risk management is becoming more prevalent, enhancing the sophistication and effectiveness of DeFi strategies. Improving the user experience through intuitive interfaces and no-code solutions is another major focus, making advanced DeFi strategies accessible to a broader audience.

Business Model

– How the protocol makes money

Furucombo generates revenue primarily through transaction fees and service charges applied to various activities performed on the platform. The protocol has implemented a fee structure that applies to different modes and operations within its ecosystem. The collected fees contribute to the protocol’s treasury and are managed by governance, ensuring the sustainable growth and development of the platform.

– What fees are charged and how they are distributed

Furucombo’s fee structure is transparent and applies to multiple aspects of the platform’s services, including Create Mode, Invest Mode, and the Lending Dashboard. Here’s a breakdown of the fees:

- Create Mode:

- Transaction Fee: A 0.2% fee is charged on the initial funds involved in any transaction created in this mode. This fee applies to actions such as:

- Swapping tokens

- Depositing or withdrawing from vaults or lending protocols

- Repaying debts

- Borrowing funds

- Sending tokens

- Bridging tokens

- Wrapping tokens

- Flash Loan Fee: A 0.2% fee applies to the volume of each flash loan transaction. However, the initial and borrowed funds within the flash loan are not charged fees.

- Transaction Fee: A 0.2% fee is charged on the initial funds involved in any transaction created in this mode. This fee applies to actions such as:

- Invest Mode:

- Fund Deposits: A 0.2% fee is applied when depositing into a fund using any token other than USDC.

- Fund Management Fees: Fund managers may charge a management fee and/or a performance fee, which are specified in the fund parameters. These fees incentivize fund managers to optimize returns for investors.

- Lending Dashboard:

- Base Fee: A 0.25% fee is charged on the operations involving collateral swaps, debt swaps, leverage, and deleverage actions within the Lending Dashboard.

- For example, if a user performs a collateral swap involving $2000 USDC, the total fee would be (2000 * 0.25%) = $5.

- General Fees:

- Initial Fund Fee: A 0.2% fee on the initial funds section, visible on the Furucombo Create Mode interface or at the top left-hand side of the page.

The fees collected from various transactions and services are deposited into the Furucombo treasury. The treasury funds are managed by governance, primarily by the holders of the $COMBO token. The governance framework ensures that the collected fees are utilized for development and maintenance, community incentives, security and audits, and marketing and growth.

Tokenomics

The $COMBO token serves multiple purposes within the Furucombo ecosystem such as:

- Fee Sharing: $COMBO holders can benefit from various revenue streams within the Furucombo ecosystem. This includes fees collected from platform usage, tokens awarded to Furucombo contracts (such as $BAL, $UNI, $SNX), and fee rebates from partnerships with protocols like Aave and Synthetix. This fee-sharing mechanism incentivizes token holding and participation in the ecosystem.

- Governance Participation: $COMBO tokens enable the community to participate in the governance of Furucombo. Token holders can propose, vote, and decide on various aspects of the platform, including the integration of new cubes, delisting of current cubes, establishing new partnerships, distributing community-reserved tokens, and granting funds to developers and combo creators. This democratic process ensures that the ecosystem evolves in line with the community’s best interests.

- Incentives for Community Growth: The $COMBO token is pivotal in incentivizing community growth. By rewarding users and builders within the ecosystem, Furucombo can foster a vibrant and active community, driving further innovation and adoption.

– Total supply and distribution

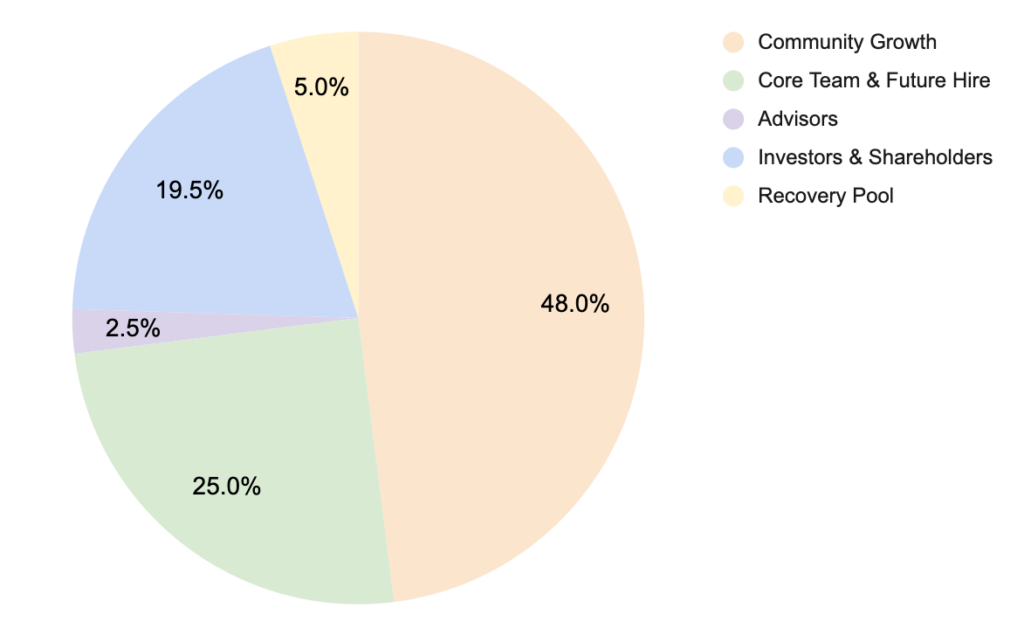

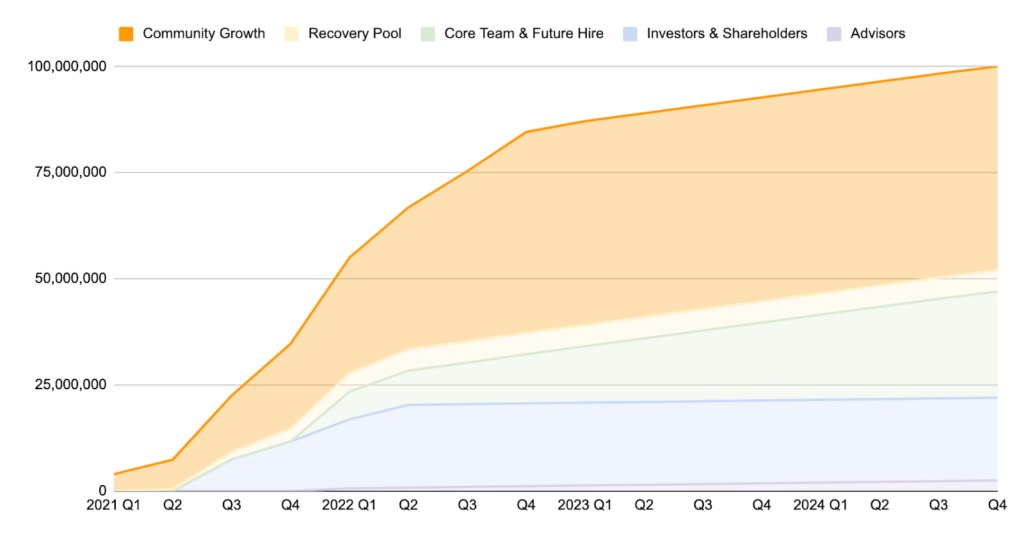

The total supply of COMBO tokens is capped at 100 million. It is allocated as follows:

- Community Growth: 48 million COMBO (48%) to incentivize participation and reward active ecosystem members.

- Core Team & Future Hire: 25 million COMBO (25%) reserved for the platform’s core team and future hires, emphasizing their commitment.

- Investors & Shareholders: 19.5 million COMBO (19.5%) allocated to align investor and shareholder interests with platform growth.

- Recovery Pool: 5 million COMBO (5%) established to address and mitigate past exploits.

- Advisors: 2.5 million COMBO (2.5%) dedicated to ensuring ongoing guidance and support from advisors.

Risks & Security

On February 27, 2021, Furucombo experienced a security incident where an attacker exploited a vulnerability in the platform’s proxy contract, resulting in the loss of over $14 million in user funds. The attack was carried out using an “evil contract” that posed as a new implementation of Aave v2. By exploiting this, the attacker was able to redirect funds to their own address.

In response to this attack, Furucombo implemented a comprehensive mitigation plan. This included issuing 5 million rCOMBO tokens to affected users, which could be claimed back as $COMBO tokens over a 360-day vesting period. Additionally, Furucombo made several updates to enhance security, such as redeploying the proxy contract and ensuring token allowances were reset to zero.

Here are the details of the audits conducted by Furucombo:

Peckshield: Peckshield has formally verified the Proxy, Registry, and handlers of the Furucombo system. Some minor issues were detected and have all been addressed.

Certora: Certora has formally verified the Proxy, Registry, and handlers of the Furucombo system. Some minor issues were detected and have all been addressed.

cure53: cure53 audited the Furucombo website and API, with no major or critical issues detected.

Dedaub: The Furucombo smart wallet and auto-farming feature contract have been audited by Dedaub, with no major or critical issues detected.

Peckshield: The Furucombo fund system contract has been audited by Peckshield, with no major or critical issues detected.

Peckshield: The Furucombo smart wallet and auto-farming feature contract have been audited by Peckshield, with no major or critical issues detected.

Dedaub: The Furucombo smart wallet and auto-farming feature contract have been audited by Dedaub, with no major or critical issues detected.

Chainsulting: The Furucombo Trevi system contract has been audited by Chainsulting, with no major or critical issues detected.

HashCloak: The Furucombo Trevi system contract has been audited by HashCloak, with no major or critical issues detected.

Peckshield: The Trevi system contract has been audited by Peckshield, with no major or critical issues detected.

Chainsulting: The COMBO token and Vesting contracts have been audited by Chainsulting, with no major or critical issues detected.

Hacken: The COMBO token and Vesting contracts have been audited by Hacken, with no major or critical issues detected.

Certik: The COMBO token and Vesting contracts have been audited by Certik, with no major or critical issues detected.

Chainsulting: The rCOMBO token contract has been audited by Chainsulting, with no major or critical issues detected.

Hacken: The rCOMBO token contract has been audited by Hacken, with no major or critical issues detected.

Certik: The rCOMBO token contract has been audited by Certik, with no major or critical issues detected.

Haechi: Compound smart wallet handler and Synthetix staking handler have been audited by Haechi, with zero critical issues found.

Risks

Using a DeFi protocol like Furucombo always involves risks, primarily due to potential smart contract vulnerabilities. Additionally, the reliance on external protocols such as Aave or Uniswap means that any failures or vulnerabilities within these integrated services can directly impact Furucombo users, potentially resulting in financial losses or disruptions in functionality.

Team

Founder – PangTing Huang

Data Analyst – Blake

Dev – Ben Huang

Dev – ZD Hu

Marketing – Zoe

Community Manager – Blazer

Project Investors

Furucombo raised $1.85 million in seed funding in early 2021 to expand its team and launch version 2 of its platform. The seed funding round was supported by prominent investors, including SevenX Ventures, Defiance Capital, 1kx, Multicoin Capital, and Aave founder Stani Kulechov. Additionally, Binance X, a developer-focused initiative from the global cryptocurrency exchange Binance, has also invested in Furucombo. The amount of Binance’s investment has not been disclosed.