ioLend

ioLend has been awarded a grant from IOTA and is currently one of 25 projects funded by the IOTA Foundation. To date, the IOTA Foundation has distributed $2.74 million to support the development of these innovative projects within the Web3 ecosystem.

Overview

ioLend is a decentralized lending protocol on the IOTA EVM ecosystem. It is a fork of Radiant Capital which is based on the Aave architecture. As the first lending platform to support $IOTA as collateral on IOTA EVM, ioLend expands the DeFi capabilities of the IOTA network.

The protocol’s core lending and borrowing functionality is based on Aave’s architecture. This includes the ability for users to deposit assets as collateral and borrow against them. Currently, ioLend supports $IOTA, $USDT, and $ETH as assets.

ioLend has integrated Radiant Capital’s model for its tokenomics and incentive mechanisms, particularly through the $IOL token and its staking system. This integration aims to enhance user engagement and long-term participation in the protocol.

ioLend’s value proposition lies in its ability to enhance capital efficiency and yield generation within the IOTA EVM ecosystem. By providing lending markets and automated leverage tools, users can access multiple yield sources while leveraging their returns. ioLend plans to incorporate yield-bearing collaterals in the future, such as $eUSD, $sDAI, $rETH, and $westETH, although these are not currently live. Once implemented, this feature will allow users to earn yields on their collateral assets while borrowing against them.

What Problem ioLend is Solving

ioLend aims to solve several challenges within the IOTA EVM ecosystem:

- Limited DeFi Options on IOTA: ioLend provides essential lending infrastructure for the IOTA EVM ecosystem.

- Capital Underutilization: The protocol allows users to put idle assets to work, earning yields and potentially amplifying gains through leveraged positions.

- Complexity of Yield Strategies: ioLend simplifies the process of executing complex yield strategies with its one-click loop feature.

- IOTA Collateral Support: ioLend is the first lending market on the IOTA EVM that supports $IOTA as collateral.

- Capital Efficiency: By creating positive capital flywheels, ioLend aims to enhance liquidity and capital efficiency in the IOTA EVM ecosystem.

Who are the Target Users of ioLend

ioLend caters to various users within the IOTA EVM ecosystem:

- IOTA Holders: Users can now utilize their $IOTA assets to earn yields and leverage positions within the IOTA ecosystem.

- Yield Seekers: Those looking to maximize returns on crypto assets can use ioLend’s yield aggregation features and leverage capabilities.

- DeFi Enthusiasts: Experienced users familiar with lending, borrowing, and leveraged positions can earn interest on deposits and borrowed assets.

- Risk-Tolerant Investors: Users comfortable with the risks of leveraged positions and active portfolio management can utilize ioLend’s infinite money loop concept.

- IOTA Ecosystem Developers: Developers can integrate ioLend’s functionalities into their applications, expanding DeFi capabilities on IOTA EVM.

- Liquidity Providers: Users can provide liquidity to ioLend’s markets, earning yields on deposited assets.

Sector Outlook

ioLend operates primarily within the DeFi lending sector which is a core component of the DeFi ecosystem. This sector allows for the creation of decentralized lending markets, enabling users to earn interest on their deposits or borrow assets by collateralizing other digital assets.

The DeFi lending sector has experienced significant growth since the DeFi summer of 2020 due to its ability to provide increased accessibility to credit, offer competitive interest rates, and ensure transparency and security through smart contracts. Smart contracts automate the lending process, reducing the risk of human error or manipulation, while allowing for real-time interest rate adjustments based on supply and demand.

Similar dApps in the Sector:

- Aave, one of the largest protocols in the DeFi lending space, offers a wide range of assets for lending and borrowing, including stablecoins and LSTs.

- MakerDAO’s Spark provides lending solutions by issuing the $DAI stablecoin against collateralized assets.

- Morpho is an emerging protocol in the DeFi lending space, offering a peer-to-peer layer that enhances the functionality of lending protocols like Aave. This layer facilitates direct matching between borrowers and lenders, bypassing traditional pooled lending structures. By optimizing these connections, Morpho aims to improve capital efficiency and potentially offer more competitive interest rates compared to standard lending pools.

As the sector matures, we can expect to see further innovations in collateralization methods, cross-chain integrations, and more sophisticated yield optimization strategies. The integration of real-world assets (RWAs) as collateral is a growing trend, exemplified by protocols like MakerDAO.

Business Model

How the Protocol Makes Money

ioLend generates revenue primarily through fees charged on its lending and borrowing operations. The protocol earns from the interest rate spread between lending and borrowing rates. It also collects fees from liquidations, with a 15% liquidation penalty applied to undercollateralized positions. The exact fee percentages are not specified in the project documentation.

What Fees are Charged and How They are Distributed

- Lending and Borrowing Fees:

- Borrowers pay interest on the assets they borrow.

- Lenders earn interest on their deposits.

- For reference, Aave charges a 0.01% borrowing fee. The exact percentage for ioLend is not specified.

- The difference between lending and borrowing rates likely constitutes a portion of the ioLend’s revenue.

- Platform Fees:

- The protocol charges platform fees, though the exact percentage is not specified for ioLend.

- Distribution: These fees are shared with users who stake $IOL-$IOTA LP tokens.

- The duration of the LP token lock affects the share of fees received (1, 3, 6, or 12 month locks available).

- Longer lock periods result in a higher share of platform fees.

- Liquidation Fees:

- When a borrower’s position needs to be liquidated due to insufficient collateral, ioLend charges a 15% liquidation penalty.

- While the exact distribution is not specified, it’s likely that a portion of this fee contributes to the protocol’s revenue. This revenue would then be shared with users who have locked $IOL-$IOTA LP tokens, as part of the platform’s fee-sharing mechanism.

- Exit Penalties:

- Users who withdraw their staked $IOL-$IOTA LP tokens before the lock period ends incur a penalty.

- These penalties range from 25% to 90%, based on how early the withdrawal is made within the 90-day vesting period.

- Distribution: These penalties are distributed to other stakers of $IOL-$IOTA LP tokens to incentivize long-term commitment.

- Early Withdrawal Penalties on $IOL Rewards:

- Users earn $IOL tokens as rewards for providing liquidity, borrowing, or lending on the platform.

- To be eligible for $IOL rewards, users must hold $IOL-$IOTA LP tokens equal to 5% of their total deposit/borrow balance.

- These earned $IOL tokens are subject to a 90-day vesting period.

- Users claiming rewards early face a penalty ranging from 25% to 90%, depending on how early the claim is made.

- Distribution: While not explicitly stated, these penalties likely contribute to the protocol’s revenue or are redistributed to remaining stakers.

Tokenomics

ioLend has a native token ($IOL) to align incentives among participants, facilitate governance, and create a sustainable ecosystem.

The $IOL token is essential for:

- Incentivizing liquidity provision and protocol usage

- Enabling decentralized governance

- Creating a mechanism for fee distribution

- Encouraging long-term commitment to the platform

What $IOL is used for

The $IOL token serves multiple purposes within ioLend:

- Governance: $IOL token holders can participate in the governance of the ioLend protocol. Governance participation is not currently live but it is planned for future implementation.

- Incentives for Deposits and Borrowing: Users can earn $IOL token emissions when they deposit or borrow assets on the platform. However, to be eligible for these emissions, users must meet specific requirements:

- They need to hold 5% of their total deposit/borrow balance in $IOL-$IOTA LP tokens.

- These LP tokens must be locked for a certain duration (1, 3, 6, or 12 months).

- Fee Sharing: Stakers of $IOL-$IOTA LP tokens receive a share of the platform fees. The longer the lock period chosen (1, 3, 6, or 12 months), the higher the share of fees received.

- Exit Penalty Distribution: When users withdraw their staked tokens before the lock period ends, they incur a penalty. These penalties are distributed to other stakers.

- Vesting Mechanism: Earned $IOL tokens are subject to a 90-day vesting period. Users can claim these tokens early, but doing so incurs a penalty ranging from 25% to 90%, depending on how early the claim is made.

Total supply and distribution

The total supply of $IOL tokens is capped at 100M tokens. The initial price was set at $0.1, giving an initial fully diluted valuation of $10M. The token distribution is as follows:

- Team and KOL allocation (20M $IOL, 20%): This allocation is for compensating the core team and key opinion leaders (KOLs) who contribute to the project’s development and promotion.

- Liquidity lock (10M $IOL, 10%): These tokens are locked to provide initial liquidity for DEXs ensuring liquidity for trading.

- Marketing and community (5M $IOL, 5%): This allocation is dedicated to marketing efforts and community-building initiatives.

- Protocol reserves (10M $IOL, 10%): These tokens are held in reserve, potentially for future development, partnerships, or to address unforeseen circumstances.

- Emissions (55M $IOL, 55%): The majority of the tokens are allocated for emissions and incentives, which are distributed to users who participate in the protocol by depositing assets, borrowing, and providing liquidity.

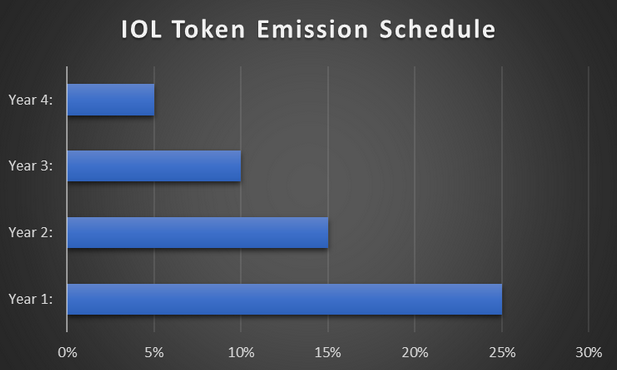

The IOL token emission schedule is designed to distribute tokens over a four-year period, with a decreasing rate of emission each year:

- Year 1: 25% of total emissions

- Year 2: 15% of total emissions

- Year 3: 10% of total emissions

- Year 4: 5% of total emissions

Risks & Security

ioLend hasn’t undergone any specific audits of its own. However, the protocol is a direct fork of Aave and Radiant, both of which have been extensively audited. As such, ioLend inherits much of their audited codebase. Nevertheless, users should be aware that any ioLend-specific modifications or additions to the original codebases could introduce new vulnerabilities.

Points of Failure and Potential Risks

- Liquidation Risk

- For Borrowers: In periods of high market volatility, borrowers’ positions may be liquidated if their collateral value falls below the liquidation threshold. Rapid price declines could lead to unexpected liquidations.

- For Lenders: If liquidations are not executed promptly during extreme market conditions, it could result in bad debt accumulation in the lending market.

- Smart Contract Vulnerabilities

- As a fork of Radiant Capital and based on Aave’s architecture, ioLend inherits the robustness of these protocols. However, any modifications to the codebase or undetected vulnerabilities in the smart contracts could pose risks to user funds.

- Oracle Failure Risk

- ioLend integrates Pyth oracles for asset valuation. While Pyth is a reputable oracle provider, any failure or manipulation of these oracles could lead to incorrect asset pricing which could lead to liquidations or allowing malicious actors to exploit the system.

- Infinite Money Loop Risks

- The 1-Click Loop & Lock feature of ioLend, which allows up to 3.33x leverage, can amplify both gains and losses. Users may not fully understand the risks associated with leveraged positions, potentially leading to significant losses during market downturns.

- Tokenomics and Incentive Risks

- The use of $IOL as an incentive token and the allocation of a portion of the 20% team and KOL tokens to KOLs presents risks. High emissions or large-scale selling by KOLs could lead to token price volatility which could affect the protocol’s sustainability by reducing user incentives and participation.

- Liquidity Risks

- Low liquidity in DEXs on IOTA EVM could lead to increased slippage and potential difficulties in executing large trades or liquidations efficiently.

Security Measures

- Pyth Oracle Integration

- The use of Pyth oracles for asset valuation suggests a commitment to accurate and reliable price feeds, which is crucial for fair liquidations and overall system stability.

- Collateral Parameters

- The protocol implements conservative collateral parameters, with a max LTV of 70% and a liquidation threshold of 80% which provides some buffer against market volatility.

- Governance Mechanism

- ioLend will incorporate a governance mechanism allowing $IOL token holders to participate in decision-making processes.

- Vesting and Lock-up Periods

- The 90-day vesting period for earned $IOL tokens and the lock-up periods for staked LP tokens (1, 3, 6, or 12 months) may help reduce the risk of sudden large-scale withdrawals and promote longer-term commitment from users.

- Liquidation Penalty

- The 15% liquidation penalty serves as a deterrent against risky borrowing and helps ensure the protocol remains solvent in case of liquidations.

Team

The ioLend team remains anonymous to the public. However, they may have completed KYC procedures as part of their application to the IOTA Grant program.

Project Investors

ioLend does not have traditional venture capital investors. Instead, the project received support through the IOTA Grants Program. This program could have potentially awarded ioLend up to $50,000, based on the team completing KYC procedures. This grant likely played a crucial role in bootstrapping the protocol, providing the necessary resources for initial development and launch.