Gamma

Gamma has been awarded a grant from IOTA and is currently one of 25 projects funded by the IOTA Foundation. To date, the IOTA Foundation has distributed $2.74 million to support the development of these innovative projects within the Web3 ecosystem.

Overview

Gamma, formerly Visor Finance, is a non-custodial, automated, active concentrated liquidity manager designed to optimize liquidity provision in DeFi. The protocol’s primary focus is on managing concentrated liquidity positions across various blockchains and DEXs. Gamma’s key feature is its vault system, which allows users to participate in liquidity provision with advanced strategies while maintaining control over their assets.

Gamma’s vault system, also known as Hypervisors, forms the core of its liquidity management strategy. These vaults automatically manage and optimize liquidity positions for users across various price ranges. When users deposit their assets into a Gamma vault, the protocol employs algorithms to dynamically adjust the liquidity concentration based on market conditions. This active management aims to maximize fee generation while minimizing impermanent loss.

What Gamma is About and Value Proposition:

Gamma’s core value proposition lies in its ability to efficiently manage concentrated liquidity positions, maximizing returns for liquidity providers while minimizing risks associated with impermanent loss.

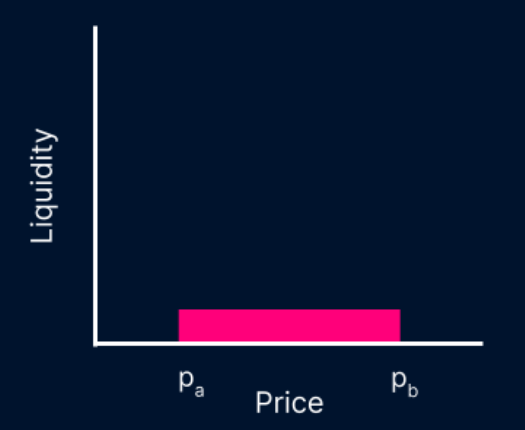

Concentrated liquidity, introduced by Uniswap V3, allows liquidity providers to allocate their assets within specific price ranges, potentially increasing capital efficiency and fee generation compared to Automated Market Makers.

The protocol achieves this through:

- Automated Strategies: Gamma employs various strategies such as Dynamic Range (Wide/Narrow), Stable, and Pegged Price to optimize liquidity provision based on market conditions and asset characteristics.

- Multi-chain Support: Gamma is compatible with over 20+ EVM-compatible blockchains, including Ethereum, Polygon, Arbitrum, Optimism, BNB Chain, and many others, allowing users to access a wide range of markets.

- Exchange Integration: The protocol supports more than 25+ DEXs, including Uniswap, PancakeSwap, QuickSwap, Camelot, and SushiSwap, providing users with diverse liquidity opportunities.

- Incentive Programs: The protocol supports various incentive mechanisms, both internal and external, to enhance yields for liquidity providers.

What Problem Gamma is Solving:

Gamma addresses several key challenges in the field of concentrated liquidity management:

- Complexity of Concentrated Liquidity: Managing concentrated liquidity positions requires constant monitoring and adjustment, which can be time-consuming and technically challenging for individual users. Gamma automates this process, making it accessible to a broader audience.

- Impermanent Loss Mitigation: By employing advanced strategies and active management, Gamma aims to minimize the impact of impermanent loss, a significant risk in liquidity provision.

- Capital Efficiency: Concentrated liquidity allows for more efficient use of capital, but it requires expertise to manage effectively. Gamma’s automated strategies optimize capital deployment across various price ranges.

- Multi-chain Fragmentation: With liquidity spread across multiple blockchains and exchanges, it can be challenging for users to manage positions efficiently. Gamma provides a unified interface for managing liquidity across various networks and platforms.

- Yield Optimization: By combining fee generation, incentive programs, and strategic liquidity management, Gamma aims to maximize yields for liquidity providers.

- Protocol Liquidity Management: Gamma offers solutions for protocols and DAOs to manage their own liquidity efficiently, addressing a crucial need in the DeFi ecosystem.

Target Users of Gamma:

- Retail Liquidity Providers: Individual investors looking to earn yields on their crypto assets without the need for constant manual management of positions.

- Experienced DeFi Users: Users familiar with concentrated liquidity concepts who seek more advanced and automated strategies to optimize their returns.

- Institutional Investors: Larger investors or funds looking for efficient ways to deploy capital across multiple DeFi ecosystems.

- DAOs and Protocols: Projects seeking to manage their own liquidity or treasury assets more effectively across various chains and exchanges.

- Yield Farmers: Users interested in maximizing returns through a combination of liquidity provision fees and additional incentive programs.

- Cross-chain Participants: Users looking to provide liquidity across multiple blockchain networks without the need to manage each position individually.

- Risk-averse DeFi Users: Investors who want to participate in DeFi yields but are concerned about impermanent loss and seek more managed solutions.

Sector Outlook

Gamma Strategies operates in the automated liquidity management sector, an emerging sector in the DeFi ecosystem with a TVL exceeding $400m. This sector focuses on optimizing liquidity provision and management across various DEXs and blockchains. The primary goal is to maximize returns for liquidity providers while minimizing risks associated with impermanent loss, market volatility, and inefficient capital allocation.

The liquidity management sector has seen significant growth and innovation in recent years, driven by the expansion of DeFi and the increasing complexity of liquidity provision strategies. As the DeFi market continues to mature, the demand for sophisticated liquidity management solutions has surged.

Several factors contribute to the growing importance of automated liquidity management:

- Capital Efficiency: As DeFi markets become more competitive, the need for efficient capital allocation has become paramount. Automated liquidity managers like Gamma help users optimize their capital deployment across various pools and price ranges.

- Complexity Reduction: The intricacies of managing concentrated liquidity positions can be overwhelming for individual users. Automated solutions simplify this process, making it accessible to a broader audience.

- Risk Mitigation: Impermanent loss remains a significant concern for liquidity providers. Advanced algorithms and dynamic rebalancing strategies employed by platforms like Gamma aim to minimize this risk.

- Multi-chain Expansion: As DeFi spreads across multiple blockchains, the need for cross-chain liquidity management solutions has increased, driving innovation in this sector.

- Institutional Interest: The growing involvement of institutional players in DeFi has led to a demand for more sophisticated and reliable liquidity management tools.

Similar dApps in the Sector:

Arrakis Finance, one of the largest liquidity management protocols, focuses on creating customizable and automated strategies for liquidity providers across various DEXs. Their platform allows users to deploy capital efficiently while minimizing impermanent loss through dynamic range adjustments and rebalancing mechanisms.

ICHI is another non-custodial liquidity management protocol that enables the use of algorithmic strategies on Uniswap V3. ICHI Vaults also allow projects to build deeper, on-chain liquidity and provide them with enticing treasury management strategies.

Charm Finance is a decentralized liquidity management protocol known for its Alpha Vaults, which employ a Passive Rebalancing strategy to optimize liquidity on Uniswap V3. Charm also integrates options-like payoffs, enabling liquidity providers to benefit from strategies with ease, all managed through a user-friendly, one-click interface that automates the complex aspects of liquidity provision

Looking forward, the automated liquidity management sector is expected to grow. Key trends likely to shape the future of this sector include:

- Integrating machine learning and AI for more sophisticated rebalancing strategies.

- Enhanced cross-chain liquidity management solutions to capitalize on arbitrage opportunities across different ecosystems.

- Increased focus on gas optimization, particularly on Ethereum mainnet, to improve the cost-effectiveness of frequent rebalancing.

- Development of more complex strategies that combine liquidity provision with other DeFi primitives like options, futures, and structured products.

Business Model

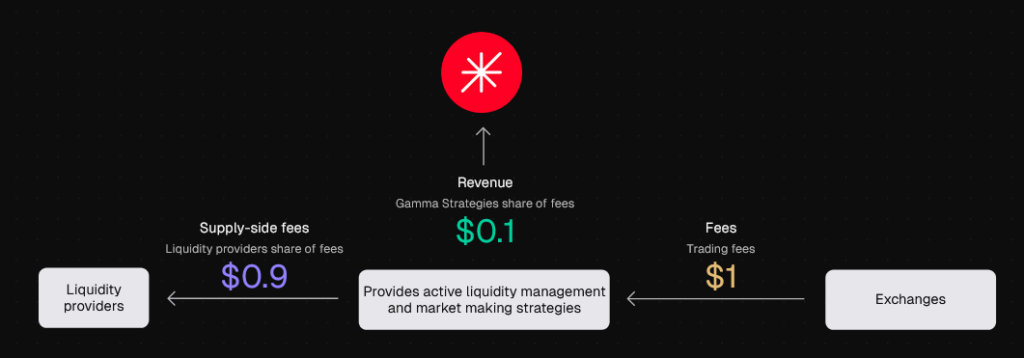

Gamma generates revenue primarily through a management fee on the trading fees generated by the liquidity pools it manages. The fee can vary between 11% to 20% depending on the specific vault.

- Management Fee (Varying from 11% to 20% of Trading Fees):

- Gamma charges a management fee on all trading fees generated by the liquidity pools managed through its Hypervisor system.

- The exact percentage varies by vault, ranging from 11% to 20%.

- For example, if a liquidity pool generates $1,000 in trading fees, Gamma would retain between $110 to $200 as its management fee, depending on the specific vault’s fee structure.

The protocol aims to maximize the trading fees generated through several strategies, which in turn increases its revenue:

- Active Liquidity Management:

- Gamma uses sophisticated strategies to optimize liquidity positions, aiming to maximize fee generation.

- Automated Rebalancing:

- The protocol uses automated systems to rebalance liquidity positions, ensuring optimal performance while minimizing costs associated with manual interventions.

- Multi-chain Operations:

- By operating across multiple blockchains (e.g., Ethereum, Arbitrum, Optimism), Gamma diversifies its revenue streams and taps into various liquidity markets.

- Custom Strategies:

- Gamma offers bespoke liquidity management solutions for specific needs like treasury management, potentially generating additional revenue through customized fee structures.

What Fees are Charged and How They are Distributed

Gamma’s fee structure is designed to benefit both the protocol and its users. Here’s a detailed breakdown:

- Trading Fees:

-

- Generated by trading activity within the liquidity pools managed by Gamma’s vaults (Hypervisors).

- Distribution:

- 80% to 89% to Liquidity Providers: The majority of trading fees go directly to the users who have deposited assets into Gamma’s vaults.

- 11% to 20% to Gamma: This management fee is Gamma’s primary revenue source, with the exact percentage varying by vault.

- Current Distribution of Protocol Revenue:

-

- Due to a recent security incident detailed below in the Risks and Security section, Gamma has temporarily restructured its revenue distribution.

- At least 45% of revenues are allocated to a Recovery Pool to compensate affected users.

- Revenue distributions to $GAMMA stakers are currently paused.

- Instead of revenue sharing, $GAMMA stakers now receive $GAMMA token emissions at a rate of 1.7M $GAMMA per year.

- Due to a recent security incident detailed below in the Risks and Security section, Gamma has temporarily restructured its revenue distribution.

The specific fee percentages for individual vaults are not available on the dapp or in the project’s documentation.

Gamma aims to maximize fee generation and overall returns through several strategies:

- Performance-based Structure: The protocol’s revenue is directly tied to the performance of its managed liquidity pools, incentivizing continuous optimization of strategies.

- Gas Optimization: Implementing techniques to minimize transaction costs, particularly important on high-fee networks like Ethereum mainnet.

- Efficient Rebalancing: While not directly charged to users, Gamma factors rebalancing costs into its overall strategy, aiming to minimize these expenses to maximize returns for liquidity providers.

Tokenomics

The $GAMMA token serves several functions within the Gamma ecosystem:

- Staking Rewards: $GAMMA token holders can stake their tokens to receive new $GAMMA emissions. Currently, these emissions are distributed at a rate of 1.7M $GAMMA per year, rewarding long-term holders and encouraging continued participation in the ecosystem.

- Future Governance Potential: While not currently implemented, the $GAMMA token will serve as a governance token in the future, allowing the community to participate in the protocol’s decision-making processes.

- Liquidity Attraction: The token helps attract liquidity to the protocol by offering additional rewards to users who provide liquidity through Gamma’s vaults.

- Ecosystem Growth: The token facilitates the growth of the Gamma ecosystem by providing a means to incentivize development, partnerships, and community engagement.

- Potential for Fee Sharing: While currently paused, the token structure allows for the possibility of resuming fee sharing mechanisms in the future, where stakers could earn a portion of the fees generated by Gamma vaults.

Total supply and distribution

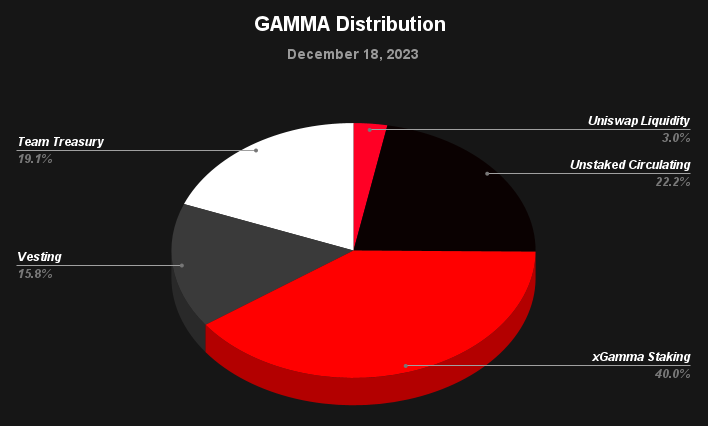

The total supply of $GAMMA tokens is capped at 100M tokens. The token distribution is as follows:

- Team Treasury (19.06M $GAMMA, 19.06%): This allocation is reserved for development, bounties, liquidity provision, partnerships, and subsidies.

- Vesting (15.84M $GAMMA, 15.84%): These tokens are subject to vesting schedules, including allocations for the team, venture capital investors, and strategic partnerships.

- Uniswap Liquidity (2.98M $GAMMA, 2.98%): These tokens are locked to provide liquidity on Uniswap, ensuring trading liquidity for the token.

- Unstaked Circulating (22.16M $GAMMA, 22.16%): This represents tokens in circulation that are not currently staked.

- $xGamma Staking (39.96M $GAMMA, 39.96%): The majority of the circulating tokens are staked by users in the xGamma staking contract.

Risks & Security

Security Incident:

On January 4, 2024, Gamma experienced a significant security breach on the Arbitrum network, resulting in losses of approximately $6.66 million across multiple vaults. The exploit was due to a misconfiguration in the deposit proxy settings, allowing attackers to manipulate pool prices and mint disproportionate amounts of LP tokens.

In response, Gamma implemented enhanced security measures, including real-time blockchain monitoring, stricter deposit controls, and regular vault simulations. The protocol has also committed to a remediation plan to compensate affected users over time using a significant portion of its revenue.

Audits

Gamma has undergone a few audits:

- Immunefi Bug Bounty Program (live since October 2021):

- Offers up to $50,000 for critical vulnerabilities with a focus on preventing loss of user funds, theft of unclaimed yield or principal, and freezing of unclaimed yield.

- Consensys Diligence Audit (March 2022):

- Focused on the Hypervisor.sol and UniProxy.sol contracts

- Arbitrary Execution Audit (March 2022):

- Also examined the Hypervisor.sol and UniProxy.sol contracts

- OpenZeppelin Audit (January 2024):

- Concentrated on the ClearingV2.sol contract, following the security incident

Note: Audits do not guarantee complete immunity from vulnerabilities or exploits.

Points of Potential Risks and Failure:

- Impermanent Loss:

- Despite Gamma’s strategies, liquidity providers may still experience losses due to price fluctuations between paired assets.

- Smart Contract Vulnerabilities: Even with audits, Gamma’s contracts may contain undiscovered bugs that could be exploited.

- Oracle Inaccuracies: Incorrect price data could lead to suboptimal rebalancing or liquidity positioning.

- Rebalancing Inefficiencies: Frequent or poorly timed rebalancing could lead to increased costs and potential losses.

- DEX and Blockchain Dependencies: Gamma’s performance relies on the proper functioning of underlying DEXs and blockchain networks.

- Configuration Errors: As demonstrated by the recent exploit, minor configuration issues could lead to substantial losses.

- Market Volatility: Extreme market conditions could challenge the effectiveness of Gamma’s automated strategies.

Security Measures

- Multisig Wallets: Gamma uses multi-signature wallets for critical protocol functions, enhancing security by requiring multiple approvals for significant actions.

- Bug Bounty Program: Gamma maintains a bug bounty program with Immunefi, offering up to $50,000 for critical vulnerabilities, encouraging ongoing security scrutiny.

- Enhanced Deposit Controls: Stricter enforcement of deposit ratios and price change thresholds, especially for stable and LST vaults.

- Regular Simulations: Gamma since the security incident conducts regular simulations on active vaults to detect potential vulnerabilities.

Team

The team behind Gamma Strategies is anonymous to the public. Despite having raised venture capital funding and receiving an IOTA grant (which typically involves KYC procedures), the team members operate under pseudo-anonymous identities.

The team structure based on the project’s documentation includes a project lead, multiple developers (back-end, front-end, and data), a lead strategist, a UI designer, and community managers. Gamma also utilizes various contractors for specialized work.

The team routinely participates in AMAs, and attends conferences, albeit without revealing their full identities.

Project Investors

Gamma Strategies initially raised $3.5 million in a Series A funding round from notable investors including 1Confirmation, Alliance DAO, Blockchain Capital, Decentral Park Capital, and Digital Currency Group (DCG). All of these investors have now fully received their vested tokens.

Currently, Gamma Strategies operates on a self-sustaining model, with protocol fees funding ongoing operations and development. The team has stated that they have sufficient funds to operate into 2025 based on current revenue levels.