In this edition, we’ll go over some of the protocols which have received grants from the IOTA Foundation. The IOTA grants program, just starting in March, has received hundreds of applicants, with 54 projects successfully receiving grants of over $6M in totality. These grants seek to incentivize teams and developers to deploy on the IOTA EVM or build new protocols on the chain, comprising teams both young and experienced. These rewards very well may be passed onto end users; this is in addition to existing incentives.

Most notably, this month the community voted to start at 172M IOTA incentives program (~$22M). In this edition, we’ll go over some of the most interesting protocols admitted to the grants program, since it’s inception until now! Let’s get into it…

GammaSwap

GammaSwap is a novel DeFi primitive built to scale liquidity in AMMs by providing better risk-adjusted returns to Liquidity Providers (LPs). The team aims to make LP yields scale better with impermanent loss risk. AMMs currently represent a one-sided volatility market and that GammaSwap can correct this inefficiency by allowing people to trade on it.

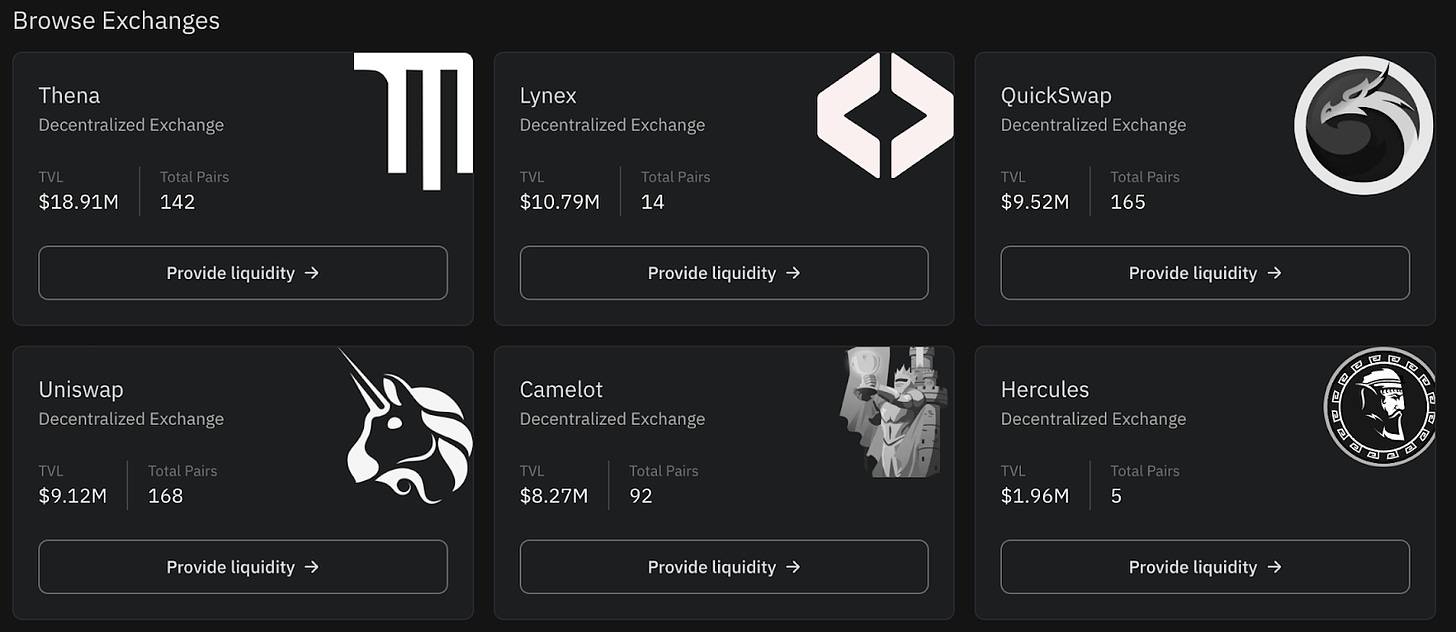

Users can provide and manage liquidity across a variety of high-profile DEXs, including Uniswap, Quickswap, Thena, Camelot, & more. The protocol already boasts nearly $62M in TVL on chains such as Arbitrum and Base, (and now IOTA EVM), an established project. GammaSwap allows people to borrow liquidity from any AMM for speculative trading on volatility, Oracle-free. Users can deploy capital into stable or volatile vaults, with additional incentives. Users can also Users can also earn a share of protocol revenue by staking the native GAMMA token, currently holding a reward rate of ~4.5% APY.

SYMMIO

SYMMIO is a permissionless protocol enabling leveraged asset trading. The protocol aims to bridge the efficiency gap between centralized and decentralized platforms. It provides a trustless, self-custodied experience while offering a product range similar to centralized exchanges. This is achieved via peer-to-peer OTC deals referred to as ‘Symmetrical Contracts’. It employs an intent-driven liquidity engine, reducing counterparty risk and allowing users to express trading preferences.

The protocol enables OTC derivatives trading on-chain through an Intent-Centric execution environment, a P2P bilateral escrow system, and economically motivated actors dubbed “Arbiters”. The protocol uses an Automated Market for Quotation (AMFQ) system, allowing users to request quotes, reducing the complexity of on-chain orderbooks in a trust-minimized way.

On the other side of the trade, market actors called “Hedgers” will provide the necessary liquidity to fill users’ orders. In this framework, one party (trader) initiates a trade, and another party (liquidity provider or Hedger) responds to the original request. Both parties must contribute collateral for trade execution, hence the bilateral agreement. The protocol differentiates between two parties, and facilitates a trustless disintermediation between them through an off-chain peer-to-peer communication system and intent-based execution environment. By isolating the capital requirements of both parties, the system can eliminate the need for oracles, optimizing capital efficiency. With this approach the protocol can match bids and asks in the market, allowing for true price discovery and trade settlement directly on-chain.

IntentX can be thought of as a framework leveraging offchain technology, providing the required infrastructure to third-party market makers and decentralized derivatives exchanges. With this in mind, various protocols have begun building on top of SYMMIO, serving as frontends for SYMMIO’s trading and liquidity engine. Two of these are actually also recipients of IOTA grants, in IntentX and Peppy.

IntentX is a perps exchange deployed on multiple chains, including Base and Mantle. By being integrated with SYMMIO, IntentX aims to incentivize market makers based on their ability to proactively hedge on-chain positions offchain. The goal of IntentX is to achieve a CEX-like experience on-chain, combining security and programmatic assurances of Ethereum with the liquidity and speed of centralized exchanges. The IntentX trading system charges a four-basis point entry/exit fee; market makers benefit from fresh quotes while filling stale ones, potentially making their business highly profitable.

Peppy aims to bring SYMMIO’s sophisticated and advanced infrastructure to retail users, and crypto natives. The protocol uses a whimsical UI and incorporates elements of online gaming to attract a different crowd, distinct from the trader bunch.

Rango Exchange

Range Exchange is another big name, operating in the bridging and crosschain swaps aggregation space. The protocol aggregates routing to find the best path for a given user’s transaction. With a massive following and nearly $3B in total trading volume, Rango, is an established bridging and swaps provider. The protocol is well connected, integrated with tokens across 100+ DEXs, 22 bridges and 24 wallets. Rango is integrated with 60+ chains, soon to include IOTA. The protocol also has an affiliate program which can be used on integrated DEXs such as 1inch to being accumulating rewards.